Getting out of student debt doesn’t have to start when you are out of school. It can happen while you are studying. By doing the research and following tried and trusted advice, you too can become debt free.

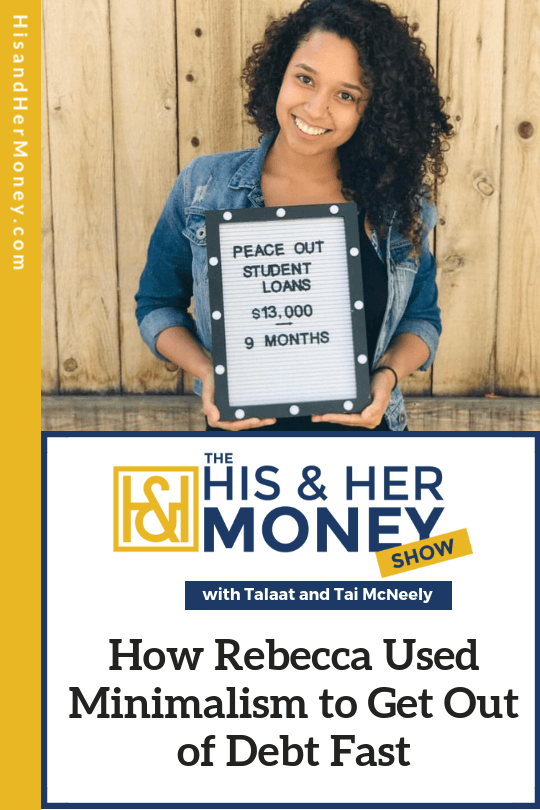

On today’s episode of The His & Her Money Show, Rebecca Patterson, a single woman shares her journey to debt freedom. She paid off $13,000 of debt. Currently, she is working in media, news, and television.

Her Story

Her loans were made up of student loans and credit cards. What sparked her decision was listening to Talaat and Tai’s story. She then found out the exact amount of her debt.

She calls herself the spending type and wasn’t really a saver, but realized she had to change her mindset regarding money. Rebecca was taught it’s fine to put purchases on her credit cards as long as she pays it back on time.

She didn’t know how to budget and felt anxious when looking at her bank statements. Rebecca started working with cash and ignored her credit cards.

Some people gave her great support and others made fun of her. But her decision to pay off her student debt before it incurred interest was too important to give up. Rebecca realized that explaining her goals to people and answering their questions it would help them understand why she seemed “cheap”.

How She Blocked Out The Noise

The big wake up call came when she looked, REALLY LOOKED at her expenses. As she did her budget for the first time, she realized that she was spending too much money on food and frivolous things.

What also dawned on her was that it would be better for her to start changing her habits while studying, instead of having a rude awakening when she entered the real world. She also didn’t want to place an unnecessary financial burden on her parents.

Her Goals

Rebecca kept her eyes on her goals. She is saving up for a car and a house. The first thing she did was to educate herself by listening to podcasts. The research breaks down the elephant into bite-sized servings. This helps with the feelings that try to overwhelm you.

She asked her mom for advice and her mom explained to her to see what her expenses were and write them down. Rebecca did this and then started setting goals for herself with specific dates. Some months were better than others, but she would have a good cry, pull herself together, and keep going.

The Prize

The day that she paid off her last payment came earlier than expected. She pushed and paid as much as she could. She told her friends and later, celebrated with her parents.

This journey taught her so much. She learned about investing, real estate, minimalism, and the value of a dollar. The principles that she learned can be used in all areas of her life. By setting goals and working towards them, she can accomplish anything she sets her mind to.

What You Will Learn

- How to change your mindset towards money

- What to do with naysayers

- How to block out the noise from the world

- Why goals keep you going

- How low-cost events help

- Why podcasts are important

- How to go after what you want and get it

Resources Mentioned

- Get in touch with Rebecca at http://rebeccaeloisapatterson.com

- Patrice Washington – Chase Purpose, Not Money

Thanks For Listening!

Thanks for tuning into us on The His & Her Money Show. If you’ve enjoyed this episode, please share it using the social media buttons at the bottom of the post.

Also, please leave an honest review for The His & Her Money Show on iTunes! Ratings and reviews are extremely helpful and greatly appreciated! Furthermore, they do matter in the rankings of the show, and we do read each and every one of them.

Today’s show is sponsored by Legal and General America. Legal & General America makes understanding and applying for life insurance easy. Also, agents are standing by to help you determine the best coverage to fit your family’s needs. Visit HisandHerMoney.com/lgapodcast to get started on your journey toward financial wellness.