When we start on a journey, whether it’s a marriage or even debt freedom, we might have concerns and those concerns might stop us from walking into our promised land. If you feel like that, this quote from General George Patton might help you.

“A good plan, violently executed now, is better than a perfect plan next week.” Your goal is not to get it right first, but get it going and then you will get it right.

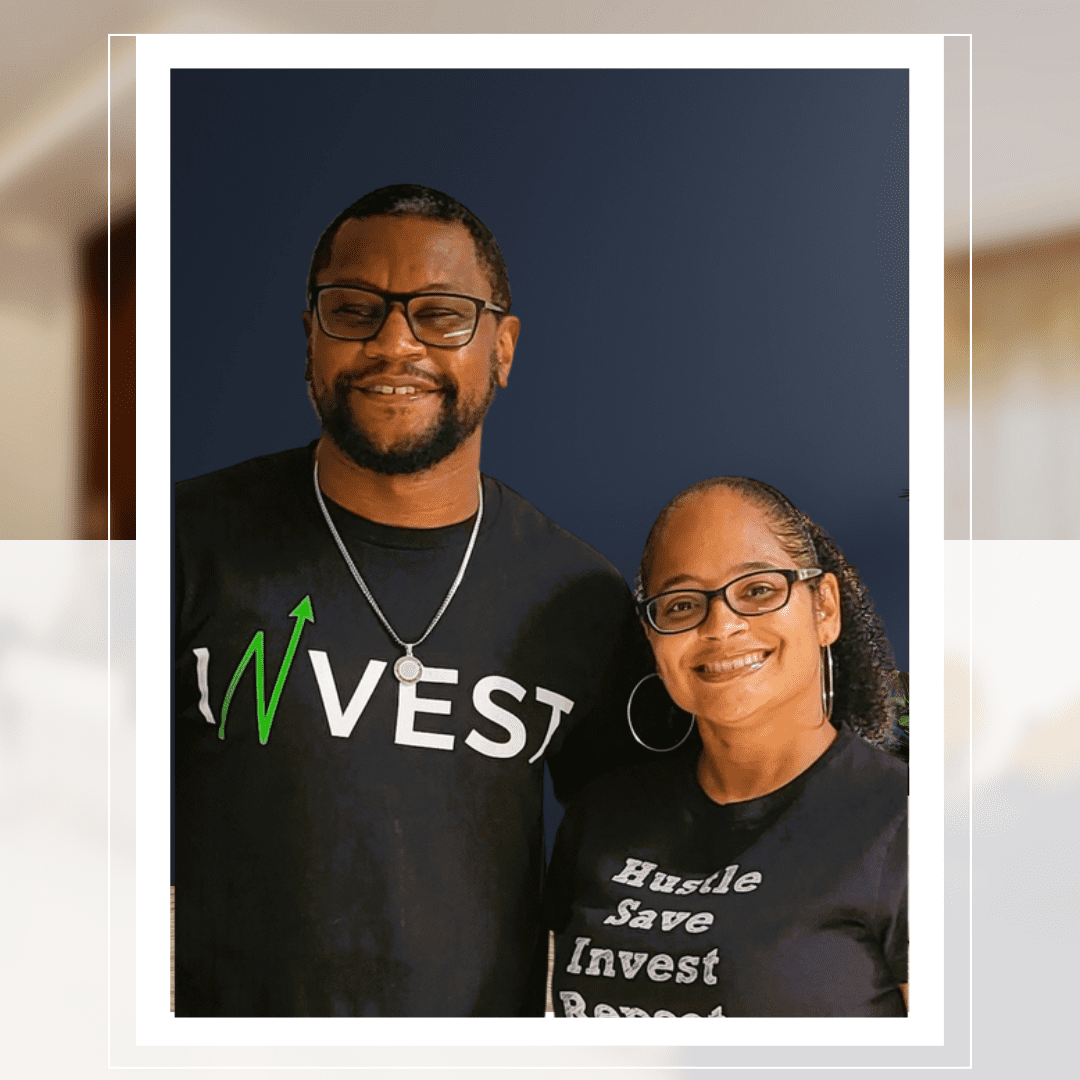

On today’s episode of The His & Her Money Show, Rob and Reshawn Lee tell us about their amazing journey of destroying debt and building wealth. Rob is a former marine, husband and father. Reshawn is wife and mother. They are empty nesters in their forties and have two sons.

Debt Basic Training

Rob’s debt journey started when he became a marine and started racking up credit card and car debt. When he went back to school, the loans got bigger and bigger. Reshawn’s debt journey began when she was a student with student loans and credit cards.

Reshawn became a single parent 2 months after her college graduation and this caused even more debt. Rob also had a lot of debt from a previous marriage. His turnaround started when he read, The Courage to be Rich by Suze Orman. Reshawn started chipping away at her debt when she started working with a 6-month-old baby to care for. Before they got married, they reviewed each other’s credit score and together they decided that they would pay off their personal credit cards before tying the knot.

Their Marriage and Their Money

At the beginning of their marriage, they were not comfortable placing all their money in one bank account. They prayed about it and realized they should join their finances. Together they collaborated to pay off the car notes, Rob’s student loan and their home loan of about $200,000 by using the principles in the book, The Total Money Makeover by Dave Ramsey.

Being a blended family, both parents had to undergo a mind shift of “our children, not my child anymore”. Knowing that the other person wants the best for you and that you no longer have to do this alone was key. They discussed their spending habits with each other.

Reshawn loves spa’s and lattes with her girlfriends and Rob likes electronics like drones, video games, and camera equipment. They placed a certain amount of money in their personal accounts as an allowance for these items. The bulk of the money was placed in their joint account. Any purchase from the joint account over $100 was to be discussed before spending it.

Attacking Their Debts

Then they attacked the debt by paying the minimum amount on all the loans and throwing any extra money at the smallest debt first, paying it off and then moving to the next debt, paying that off and so on.

It was during this time that they decided to purchase two luxury cars and got into a bit more debt. Conversely, they placed $1000 in a 529 for a college fund for their children. Additionally, they upgraded their home to make it feel new again.

Destroying Debt and Building Wealth

In 2013 they had crushed all their consumer debt, bought a new home for themselves and converted their old home into a rental property. In 2014 they bought another property for rental income and bought 2 more in 2015. They used their 6-month emergency fund and converted it into a rental property.

They used a property manager to manage the properties. Their properties maintained themselves and they didn’t come out of pocket in these investments. They learned about a cash-out refinance, which is a strategy that is used by real estate investors to purchase more properties whereby you take the equity of an existing home or rental and use that money to purchase your next property if you don’t have cash on hand to make the purchase.

They also use the ten thirty-one exchange rule which is: you can sell an existing property and roll the profits into a larger investment as long as you don’t touch any of the profits. Moreover, they also took advantage of small multi-family rental (consisting of between 2 to 10 units).

Their portfolio now consists of a 6 unit and two single-family homes, as well as their own home that they paid off in 2018! They were the first in their families to do this and they do this to leave a legacy of good financial knowledge for their children.

They left their corporate careers in 2018 and began a travel agency. Their plans for 2019 is to take a sabbatical and travel for one solid year, by visiting every continent.

Get in touch with Rob and Reshawn at http://learnhustlegrow.com

WHAT YOU WILL LEARN IN THIS EPISODE

- Solutions for blended families finances

- Why having an allowance as an adult will help you with your debt freedom journey

- Having tough financial conversations will help your marriage

- Why pre-marital counseling at church will help you with marital roles and responsibilities

- The do’s and don’ts of real estate investing

- What is a cash-out refinance, a ten thirty-one exchange, and a small multi-family rental

RESOURCES

- The Courage to be Rich by Suze Orman

- The Total Money Makeover by Dave Ramsey

THANKS FOR LISTENING!

Thanks for tuning into the His & Her Money Show. If you have any comments or questions about today’s episode, please let us know your thoughts in the comment section below. If you’ve enjoyed this episode, please share it using the social media buttons you see at the bottom of the post.

Also, please leave an honest review of the His & Her Money Show on iTunes! Ratings and reviews are extremely helpful and greatly appreciated! They do matter in the rankings of the show and we do read each and every one of them.

Today’s show was sponsored by Teach Me How To Budget. If you are ready to gain freedom in your finances once and for all then enroll in our brand new personal finance course Teach Me How To Budget.