Inspiration is something we all need, especially when we are pushing towards a goal. Hearing and listening to stories of people that have attained what we have set out to do, can give us that push, that nudge we need, to do what we need to do.

Or to change that mindset that we have been caught in and has held us back. Or to let us know that we are not alone and there are other people that have done that which we are doing.

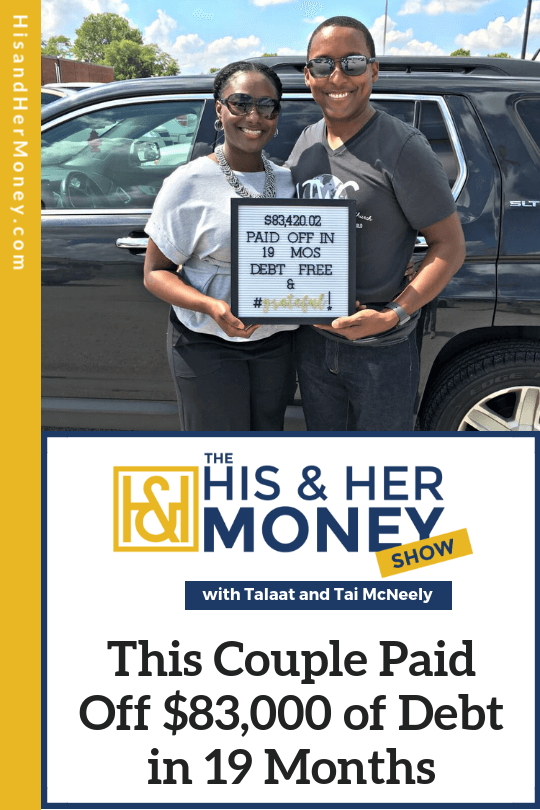

On today’s episode of The His & Her Money Show, Prentice and Dionne Motley, a debt-free couple, tells us their inspirational freedom story of being a good steward with their money.

Prentice is a Process Engineer by day and a Financial Coach by night. Dionne is a Contract Administrator by day and a Financial Coach by night.

They admit it took them years to stop making bad financial decisions. But when they did, they started coaching other couples regarding their finances.

Introduction to Debt

Dionne was introduced to debt when she arrived at college and the credit card companies gave her a credit card with a $1,000 limit. From there, the cycle of debt started. Prentice started his debt cycle with credit cards when he was second-year in college.

Prentice realized that they were in a bad place because they were living paycheck to paycheck. Furthermore, if anything went wrong, they would be in real trouble.

Dionne’s wake up call came when she was working at a banking institution and they refinanced their 30 year home loan for the second time. She looked at the home loan statements and realized with a thud that, just in interest alone, they had paid for the house two times over, and it wasn’t even their dream home!

Creating a New Vision

They created a vision board at the end of 2016 to stop the old bad spending habits from coming back. In 2017 they attended Financial Peace University at their church and did everything they could do and became debt free.

The gained the confidence they needed to share their journey with others. They downsized their life. Moreover, together they paid off $83,000 consumer debt in just 19 months. Despite some setbacks, they did not give up.

Prentice and Dionne love the peace that this gives them. They will be able to leave a great legacy for their children by staying away from debt and teaching them to do the same.

They experience gratitude every day because even though their journey took a while, it did come to pass. Their motivating words for other couples are: You owe it to yourself because you have nothing to lose… except for the debt!

Get in touch with Prentice and Dionne at www.motleyfinancialsolutions.com.

WHAT YOU WILL LEARN IN THIS EPISODE

- How to not give up and persevere paying off debt

- How to stop living paycheck to paycheck

- What happens when we surrender our lives, even our finances, to the way God intended it to be

- How prayer will help you in all situations

- Why courses really do help and work

- How to surround yourself with like-minded people

- How to stop those bad spending habits

RESOURCES

THANKS FOR LISTENING!

Thanks for tuning into the His & Her Money Show. If you have any comments or questions about today’s episode, please let us know your thoughts in the comment section below. If you’ve enjoyed this episode, please share it using the social media buttons you see at the bottom of the post.

Also, please leave an honest review of the His & Her Money Show on iTunes! Ratings and reviews are extremely helpful and greatly appreciated! They do matter in the rankings of the show and we do read each and every one of them.

Today’s show was sponsored by Crush My Mortgage. If you are ready to accelerate the process of paying off your home mortgage and become truly financial free once and for all then enroll in our brand new online course Crush My Mortgage.