Sticking to a budget is probably one of the most common frustrations people have with their personal budgets. Most times it is because there is a lack of budget organization. Proper organization is key to maintaining and sticking to a budget. We’ve compiled a list of the 5 best budget apps that are free that will help your money get organized once and for all!

5 Best Budget Apps That Are Free

1. Budget Simple

The website that we personally use to do our budget every month is Budget Simple. Budget Simple, is a free budgeting and personal finance tool that focuses on making sure you have a budget that works for you.

Budget Simple aims to make the process as easy and approachable as possible and promises that an hour with the tool will give you a better understanding of where your money is going.

Once you have your budget and you’re all set up, it’s a matter of keeping your finances in check, and the tool helps you with that as well. BudgetSimple is completely free. However, if you want mobile apps or the option to fully link your bank accounts, you’ll need a $5/mo premium account.

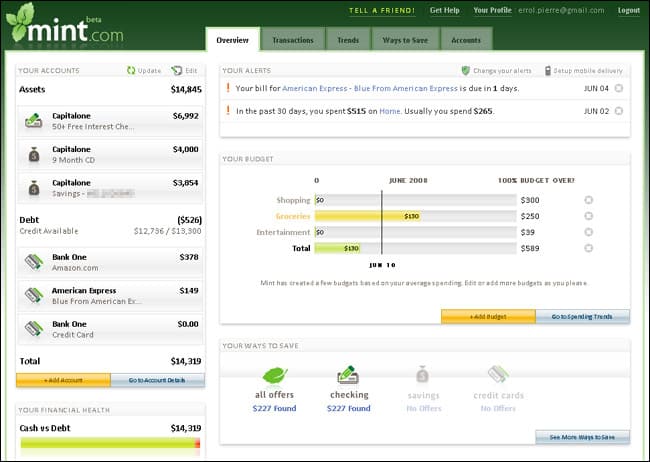

2. Mint

Mint is free, web-based, and was one of the first free, web-based personal finance tools to plug into all of your banks, investments, retirement funds, credit cards, and other financial accounts to quickly give you a complete picture of your financial health.

This app also lets you draw up a household budget and warns you if you’re not sticking to it, see how much you’re spending on what types of purchases or utilities, set up savings goals, and actually stick to them.

Mint doesn’t touch your money itself—it just uses read-only access to show you everything—but it does suggest financial products to you that might save you money in the long run, like lower-interest credit cards or higher-interest savings accounts.

>>>VIDEO: Our Budget Busters and How We Battle Them<<<

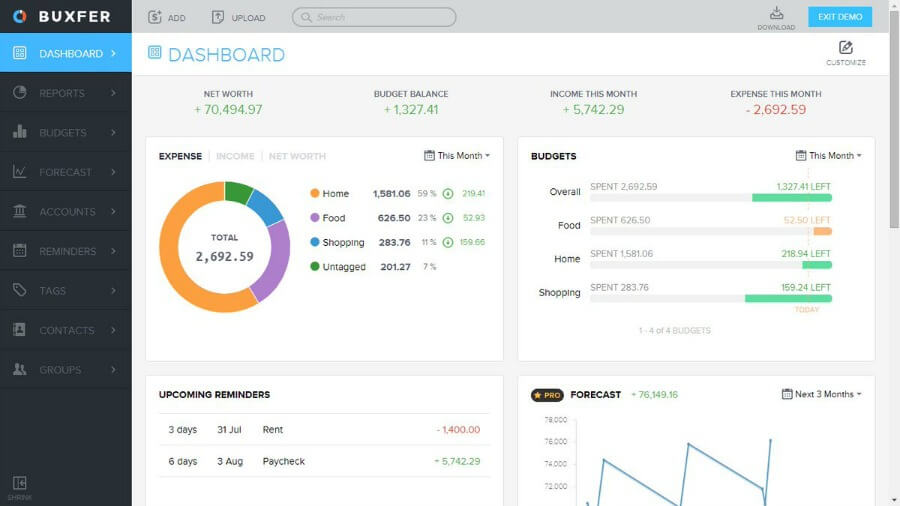

3. Buxfer

Buxfer.com is another popular budget-management tool. Like Mint, it provides income and account information, online security and budget/spending categories. Buxfer’s site is user-friendly and well-designed, and it features a free, live demo.

Buxfer specializes in budgeting and tracking group expenses. This simple online money management service allows users the cool features of tracking loans and IOUs from friends and family as well as providing group budgeting.

They offer three packages: Basic – which is free but limited to five accounts and budgets; Plus – which gives unlimited accounts and budgets for $3.99 a month; and Pro – which gives you all of the above, plus forecasting, advance reports, online payments and automatically backed up data.

4. Budget Tracker

Budget Tracker specializes in tracking transactions, with or without a link to your bank account log-in information. The unique feature to this one is the ability to customize applications on the site, creating more things for the tool to track and letting you choose what to display from dates and titles to amounts and more specific details.

The results from the tracking are shown on your calendar and in graphs on the site. You can even use other applications created by other users on the site. Forecasting outcomes, scheduling income dates, and various business-based features are available.

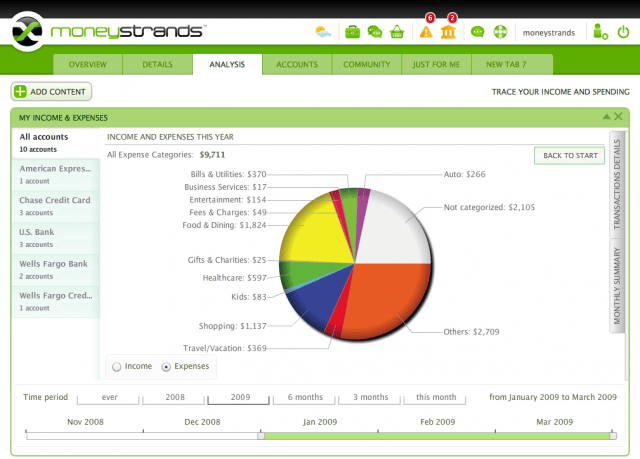

5. moneyStrands

Like the other tools, moneyStrands can help you visualize your bill payments and spending on its calendars, bar graphs, and more. However, this budgeting tool focuses more on financial planning than on tracking transactions.

It can still automatically track your expenses by linking the service to your bank accounts. However, moneyStrands goes further by generating budgets based on spending habits. To add to this, they use this information to generate. personal financial tips for each user.

With these 5 best budget apps, you’ll be sure to become a budget rockstar! Also, we highly recommend that you don’t let a month go by without creating a budget for your household. Your budget is a roadmap for your money. Furthermore, you’ll find another level of peace and less worry about your financial affairs simply because you’ve now created order.