Policygenius Review: Finding the Best Insurance Policies Has Never Been Easier

Written by Talaat & Tai on May 26

Policygenius Review: Finding the Best Insurance Policies Has Never Been Easier

If you’re searching for a reliable and efficient way to compare and purchase insurance policies, look no further than Policygenius. In this comprehensive Policygenius review, we’ll delve into the platform’s benefits, services, types of insurance policies available, the process for comparing insurance quotes, how to use the online platform, customer service, and support options, and the legitimacy of Policygenius. By the end of this article, you’ll have a thorough understanding of what Policygenius has to offer and why it stands out among other insurance marketplaces.

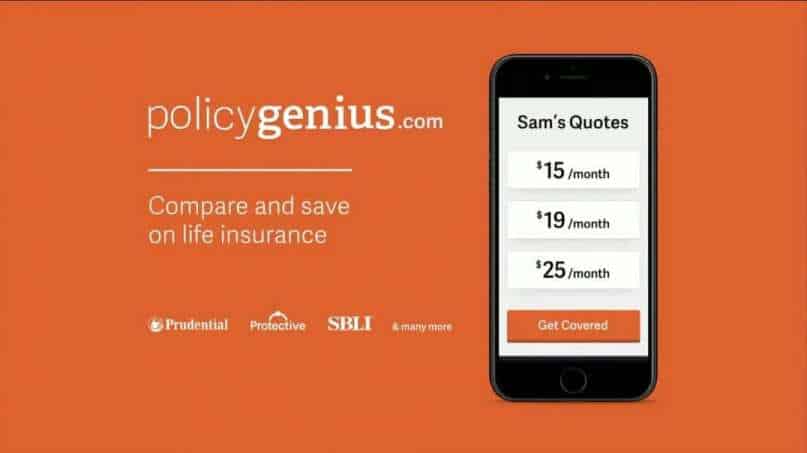

This online marketplace offers a convenient platform for comparing policies from over a dozen different insurance providers, including well-known names like Brighthouse Financial and Lincoln Financial Group. Furthermore, Policygenius caters to various insurance needs, including life, renters, homeowners, and pet insurance.

Benefits of Policygenius: Empowering Insurance Shoppers

Are you in search of an insurance policy that meets your unique needs? Policygenius is the answer. As a licensed independent insurance broker and online marketplace. Moreover, Policygenius empowers you to compare quotes and coverage from top insurance providers. Here are some key benefits of using Policygenius:

- Expert advice: Not sure which type of insurance is right for you? Policygenius has you covered. Their team of licensed agents is ready to answer your questions, providing you with expert advice to help you make confident coverage decisions. Additionally, their informative blog and resource center offer helpful tips and insights.

- Convenience: Say goodbye to spending hours on the phone with insurance providers. Policygenius’ online quote tool enables you to receive personalized quotes in just minutes. Their platform also allows you to manage your policies and coverage all in one place, saving you time and effort.

- Wide range of coverage options: Policygenius understands that everyone has different insurance needs. Whether you require life insurance, renters insurance, pet insurance, or even jewelry insurance, Policygenius has options for you. Their partnerships with top insurance providers ensure that you have access to the best rates and coverage options.

- Health and financial ratings: Policygenius provides financial and health ratings for its partnering insurance providers. Moreover, this feature gives you peace of mind, knowing that you’re choosing a reputable and secure option for your insurance coverage.

With Policygenius, finding and managing your insurance policy has never been easier. Join the thousands of satisfied customers who have found coverage tailored to their specific needs. Get started with Policygenius today!

What is Policygenius? Your One-Stop Insurance Shop

Are you feeling overwhelmed by the multitude of insurance options available in the market? Policygenius is here to simplify the process. As an online marketplace, Policygenius partners with top insurance providers to offer a wide range of coverage options, catering to everything from life insurance to pet insurance. With licensed agents ready to provide expert advice and a user-friendly online platform, Policygenius is the perfect solution for anyone looking for convenient and comprehensive insurance coverage.

Services Offered by Policygenius

Policygenius understands that insurance shopping can be a daunting and overwhelming task. They offer a platform that connects consumers with multiple insurance providers, helping them find the perfect policy to fit their needs.

As an intermediary, Policygenius works on behalf of the consumer, providing access to multiple rate quotes and policy options from a variety of trusted insurance companies. With just a few clicks, prospective purchasers can compare coverage amounts, types of insurance policies, and monthly premiums, all tailored to their zip code, medical history, and more.

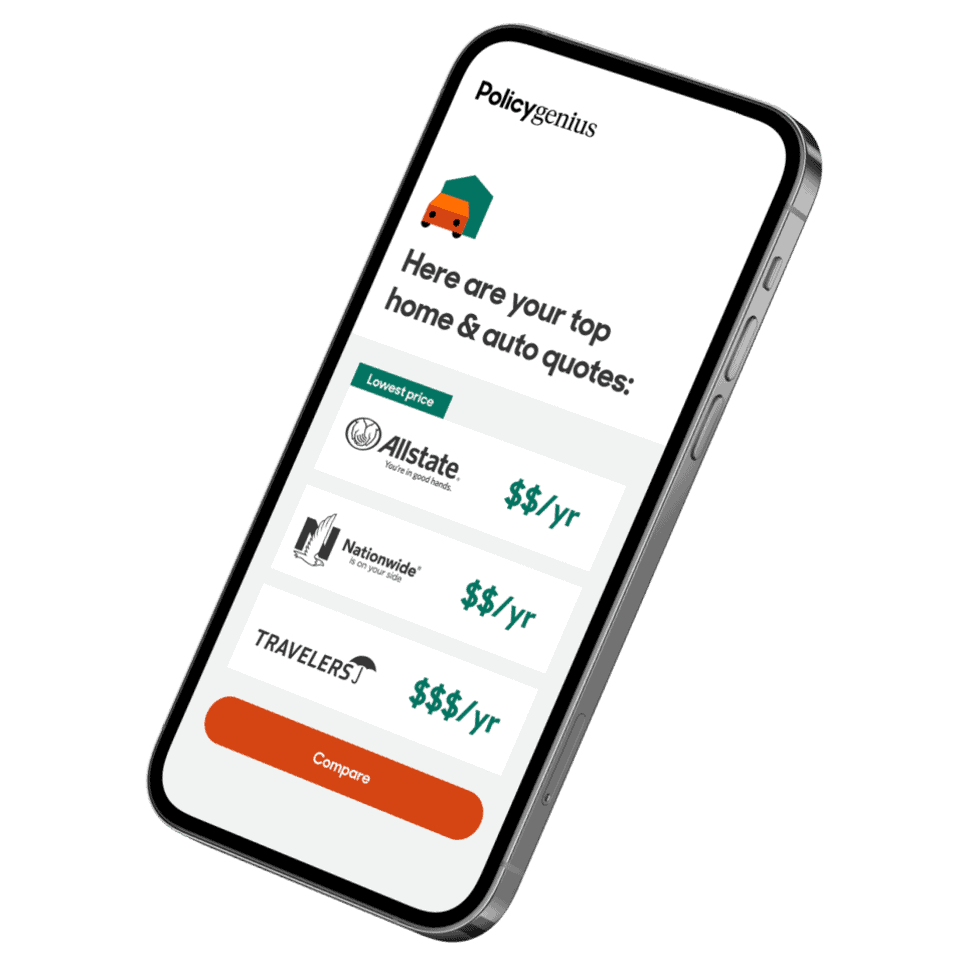

When it comes to policies, Policygenius offers a wide range of insurance types, including life insurance, renters insurance, pet insurance, homeowners insurance, disability insurance, long-term care insurance, auto insurance, and even identity theft insurance. Moreover, they have coverage options for protecting the family’s future, valuable possessions, and personal health and well-being.

Policygenius prides itself on offering top-notch customer service and support throughout the entire process. Their team is always available to answer any questions and guide customers step-by-step through policy terms and the underwriting process, ensuring a full understanding of the coverage being purchased. They communicate in plain English, eliminating the need for customers to navigate complicated insurance jargon.

In a market inundated by insurance companies, Policygenius exists to simplify the process, save customers time and money, and ensure they get the coverage they need.

Types of Insurance Policies Available

Individuals in need of insurance coverage to protect their loved ones, assets, or even their furry friends can turn to Policygenius. They offer a wide range of insurance policies tailored to specific needs, all available for easy comparison on their platform.

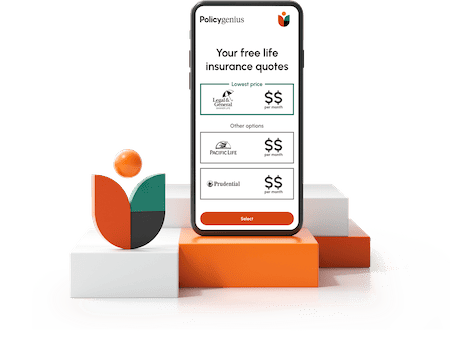

First and foremost, Policygenius provides both term and whole life insurance policies to safeguard loved ones in the event of a tragedy. Their term life insurance policies offer coverage for a specified number of years, while whole life policies provide lifelong protection with built-in cash value. By leveraging Policygenius, individuals can conveniently compare quotes from multiple top-rated providers to find the most suitable coverage at the best price.

Policygenius’s coverage options extend beyond traditional life insurance policies. They also offer pet insurance to cover unexpected veterinary bills, homeowners insurance to safeguard vital assets, and renters insurance for individuals residing in apartments or other rental properties. Furthermore, their long-term disability insurance offers income protection in the event of illness or injury that renders a person unable to work.

For those seeking even more specialized coverage, Policygenius’s platform includes vision insurance, long-term care insurance, jewelry insurance, travel insurance, and identity theft insurance. With such a broad range of options, individuals can discover coverage that aligns with their unique needs and lifestyle.

Additionally, Policygenius assists individuals in protecting their assets even after they pass away. Their platform enables the creation of wills or trusts starting at just $120.

At Policygenius, comparing and selecting insurance policies has never been more convenient. Their comparison tool allows users to easily view and compare policies and providers side-by-side, empowering them to make informed decisions about their coverage. Whether one is safeguarding their family, home, pets, or personal health, Policygenius offers the ideal policy for their needs.

How to Compare Insurance Quotes on Policygenius

Comparing insurance quotes on Policygenius is a straightforward process that can be completed in a few simple steps:

- Visit the Policygenius website: Start by visiting the Policygenius website at www.policygenius.com.

- Select the type of insurance you need: On the homepage, you’ll find a list of insurance types. Choose the type of insurance you’re interested in, such as life insurance, renters insurance, homeowners insurance, or pet insurance.

- Provide relevant information: Policygenius will require some basic information to provide accurate quotes. You may need to enter details such as your age, ZIP code, coverage amount, and any specific requirements related to the insurance type.

- Compare quotes: Once you’ve provided the necessary information, Policygenius will generate a list of quotes from various insurance providers. You’ll be able to compare coverage options, policy details, and premiums side by side.

- Customize your policy: If you find a quote that meets your requirements, you can customize the policy further. Policygenius allows you to adjust coverage amounts, policy terms, and additional riders to tailor the policy to your needs.

- Apply for coverage: Once you’re satisfied with a specific policy, you can proceed to apply for coverage directly through Policygenius. They will guide you through the application process, and their team can assist you with any questions or concerns.

Policygenius simplifies the process of comparing insurance quotes by aggregating information from multiple providers in one place. This saves you time and effort, ensuring that you can make an informed decision based on your specific insurance needs.

How to Use Policygenius’ Online Platform

Looking to get an insurance policy at a great price? You’re in the right place! Policygenius offers a quick and easy way to compare policies from different insurance providers all in one place. Here’s how to get started:

Step 1: Explore the Platform’s Features and Tools

Their online platform has a range of features to make the process of getting a quote simple and convenient. Once you’re on Policygenius’ website, you’ll be able to see all the types of insurance policies we offer, including life, renters, pet, and auto insurance. Moreover, you can also find information on some of the industry’s top providers, so you can get a better understanding of the options available to you.

Step 2: Enter Your Zip Code

When you’re ready to get a quote, enter your zip code. This will allow our platform to access the insurance policies available for your area, ensuring the plans you compare are relevant and available in your location.

Step 3: Select Your Insurance Type and Provide Details

After entering your zip code, choose the type of insurance policy you’re interested in. They offer a range of insurance types, so you’re sure to find one that suits your needs. From there, it’s time to provide us with some basic details like coverage needs, deductibles, and other pertinent information. Just sit back and watch as their platform generates insurance policy options from various approved providers.

Step 4: Compare the Different Policies

Now that you have a range of policies to choose from, you can compare prices, coverage, and other features to find the plan that works best for you. Policygenius allows you to adjust coverage and additional features, as well as compare pricing from different insurance providers. This way, you can make an informed decision about which option is best for your needs.

Step 5: Apply for Your Chosen Policy

After comparing the options and choosing a policy, you can apply for coverage straight from their website. They’ll guide you through the process, ensuring you don’t miss any important steps. Plus, their licensed agents are always available to assist you with any questions or concerns you may have.

So there you have it – using Policygenius’ online platform is quick, easy, and convenient. They’re dedicated to providing you with the best options available while ensuring you have all the information you need to make the right decision for your insurance coverage needs. Give it a try and let them help you find the policy that best suits your needs and budget.

Customer Service and Support Options

Policygenius aims to provide excellent customer support and assistance throughout the insurance shopping process. Here are the ways you can reach out to their team:

- Phone: You can contact Policygenius by phone during their business hours. The phone number is available on their website. Furthermore, you can speak directly with a licensed agent who can assist you with any questions or concerns.

- Online chat: Policygenius offers an online chat feature where you can chat with a representative in real-time. This can be a convenient option for quick inquiries or clarifications.

- Email: If you prefer written communication, you can send an email to Policygenius with your questions or concerns. They strive to respond to emails promptly and provide the assistance you need.

Policygenius aims to deliver excellent customer service, ensuring that you have a smooth and hassle-free experience while shopping for insurance. Whether you need help understanding policy details, comparing quotes, or navigating the application process, their team of licensed agents is available to assist you every step of the way.

Is Policygenius Legitimate?

Yes, Policygenius is a legitimate and reputable company in the insurance industry. They are a licensed insurance broker and operate as an intermediary between consumers and insurance providers. Policygenius partners with well-known insurance companies to offer a wide range of coverage options. Furthermore, their platform provides accurate quotes, transparent policy information, and a secure application process.

Policygenius is committed to maintaining high standards of customer service, privacy, and data security. They adhere to industry regulations and take appropriate measures to protect customer information.

Additionally, Policygenius has been recognized and featured in reputable publications such as Forbes, The New York Times, and CNBC, further highlighting its credibility and reputation in the insurance industry.

You can feel confident using Policygenius as a reliable and trustworthy platform for comparing and purchasing insurance policies.

Licensing and Regulations for Policygenius

Are you in the market for insurance but don’t know where to begin? Look no further than Policygenius, the online insurance marketplace that connects consumers with licensed, independent brokers. And as a regulated and licensed entity, Policygenius is dedicated to ensuring full compliance with state and federal insurance laws.

In all states where Policygenius operates, the online insurance marketplace is licensed and regulated by the appropriate departments. In fact, Policygenius is licensed by the New York Department of Financial Services under the entity number 160228.

As a third-party platform connecting consumers with independent brokers, Policygenius does not provide any insurance products of its own. However, the company has built relationships with top providers to offer a wide selection of insurance products including life, renters, pet, auto, and home policies.

To ensure that it operates within legal limits, Policygenius is required by state regulators to follow strict laws on data privacy and information-sharing policies. Furthermore, the company is dedicated to protecting the sensitive information provided by customers in their search for insurance.

So if you’re looking for a hassle-free way to compare insurance quotes and find the best policy for your needs, let Policygenius help. With their licensed and regulated status and dedication to data privacy, you can trust that you’re in good hands.

Customer Reviews and Testimonials

If you’re considering Policygenius for your insurance needs, you’ll be happy to know that their TrustScore on TrustPilot is currently “Excellent”. With over 2,900 customer reviews, it’s clear that Policygenius customers are satisfied with their experience.

What do customers love about Policygenius? Well, many of them praise the company’s quick and easy application process, efficient communication, and low cost. One happy customer, Tanya M, writes, “Policygenius was amazing to work with – they found me the absolute best rate for term life insurance and the process was so smooth!”

Here are a few more quotes from satisfied Policygenius customers:

– “I was able to work with an amazing representative who took time to understand my specific needs. It was a very personal experience and I felt very taken care of.” (Sarah B.)

– “The application process was quick and easy. The policy terms are easy to understand and the pricing is very reasonable. I would recommend Policygenius to anyone.” (Ryan C.)

– “I had a great experience with Policygenius and would recommend them to anyone who is looking for insurance. They were very responsive and made the entire process easy and enjoyable.” (Nicole L.)

At Policygenius, customer satisfaction is a top priority, and it’s clear that they’re getting it right. So, why not join the thousands of customers who have already enjoyed a positive experience with this trusted marketplace? Give them a try and see for yourself why their TrustScore on TrustPilot is so high. And don’t forget to share your own review or testimonial to help others find the right insurance coverage.

As you browse through Policygenius reviews, you might find it helpful to include visual aids like images or screenshots to further emphasize customer satisfaction. This way, you can see firsthand the benefits of working with Policygenius, and make an informed decision.

Financial Stability of the Company

One should not overlook the financial stability of a company when selecting an insurance provider. Policygenius is a trustworthy option in this regard, with an outstanding credit rating and a reputation for only working with reputable insurance providers.

Policygenius has a credit rating of A- from AM Best, an independent credit rating agency that evaluates the financial strength and stability of insurance companies. This rating indicates the company’s ability to meet its financial obligations, such as paying out insurance claims. Additionally, Policygenius only partners with insurance providers that have strong financial stability ratings, such as Brighthouse Financial and Lincoln Financial Group.

Furthermore, Policygenius has earned an A+ rating from the Better Business Bureau, a nonprofit organization that rates and accredits businesses based on their trustworthiness and ethical practices. This rating demonstrates Policygenius’ commitment to providing excellent customer service and being transparent with its practices.

In terms of the insurance companies that Policygenius works with, they all have strong financial stability ratings. For example, Brighthouse Financial has been rated A by AM Best and A+ by Standard & Poor’s, indicating the company’s stability and ability to honor its policyholder obligations. Lincoln Financial Group also has an A rating from AM Best and an A+ rating from Standard & Poor’s.

In conclusion, financial stability is a crucial factor to consider when selecting a company to purchase an insurance policy. Moreover, Policygenius is a reliable and trustworthy option with a strong credit rating, an A+ rating from the Better Business Bureau, and a reputation for only partnering with reputable insurance providers. So, you can have peace of mind knowing that you are purchasing insurance policies from a company that you can rely on.