*This post is sponsored by Serve ®. All opinions are 100% my own.

A prepaid card can be a great way to manage your money, but it’s important to understand what a prepaid card is and how they work before you sign up.

Many stores are developing a more significant online presence to adapt to the rapid advancements in mobile technology. For many merchants, a large percentage of customer orders are now placed online with the option for curbside pickup or same-day courier delivery.

To access convenient delivery options that do not require a customer to enter the store, payments must be completed in advance using a credit or debit card with no option to pay cash. Naturally, many consumers have security concerns entering their payment information into a mobile app or computer, with new data breaches occurring almost daily.

Despite many things being online in 2022, there are still ways around having all of your vital information – like bank account numbers – out there waiting to be hacked. Prepaid cards may be an excellent alternative to help consumers privately access card-based payment services without linking to a bank account or credit card.

What Is a Prepaid Card?

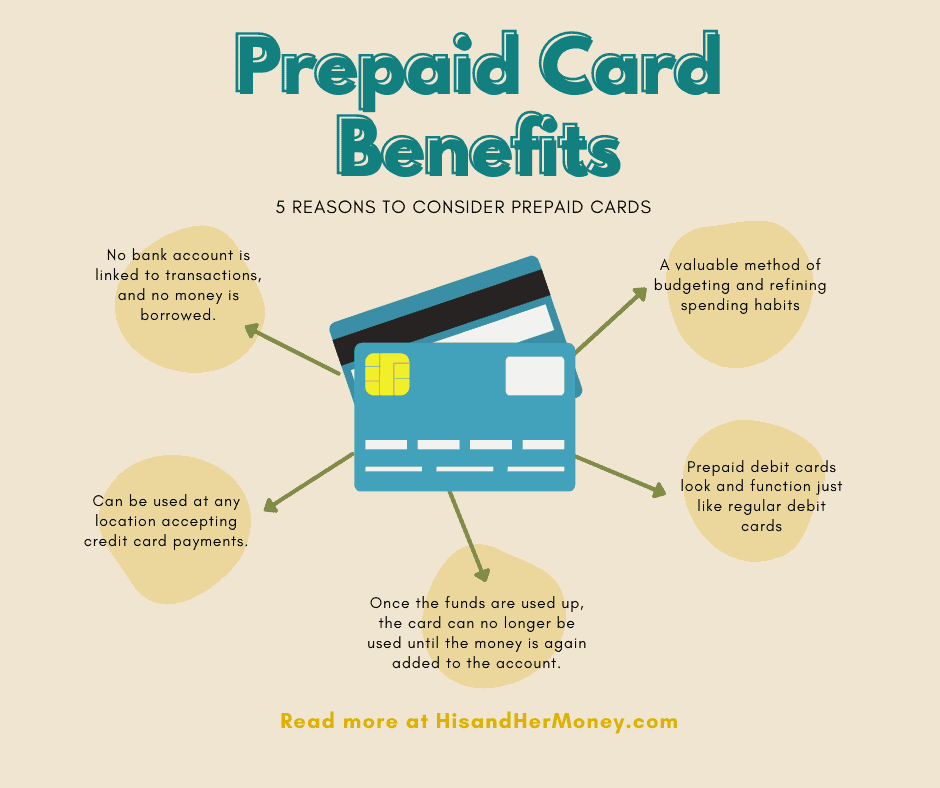

A prepaid card is a payment card that has money loaded onto it prior to its use. The card owner can spend whatever amount of money is present on the card at any participating retailer. Unlike a debit or credit card, no bank account is linked to transactions, and no money is borrowed. When the balance becomes depleted, the card is no longer available for use until funds are reloaded.

How Do Prepaid Cards Work?

Many banks and credit card companies offer prepaid cards as an option for consumers who do not want to go the traditional route. Since prepaid cards are associated with major companies like Visa, prepaid cards can be used at any location accepting these forms of payment.

Obtaining a prepaid card does not require a bank account or credit history and can be used for payments until the card balance has been depleted. Once the card is empty, the owner can replenish the balance by adding more funds back onto the card.

The most common reasons for having a prepaid debit card are convenience and budgeting purposes. For example, money can be loaded onto the card at the beginning of the month for groceries, gas, and shopping expenses. Once the funds are used up, the card can no longer be used until the money is once again added to the account.

Sometimes confused with secured credit cards, prepaid debit cards do not help consumers build up their credit history. Since no money is borrowed from a lender, transaction and payment history are not tracked or reported to the major credit bureaus.

How to Add Money to Prepaid Cards

Prepaid cards typically have to be preloaded with a minimum amount of funds if purchased at a retail location. For the Serve® Pay As You Go Visa® Prepaid Card, a minimum load of $20 is required when purchased in-store.

Additional funds can be added to your card in several different ways.

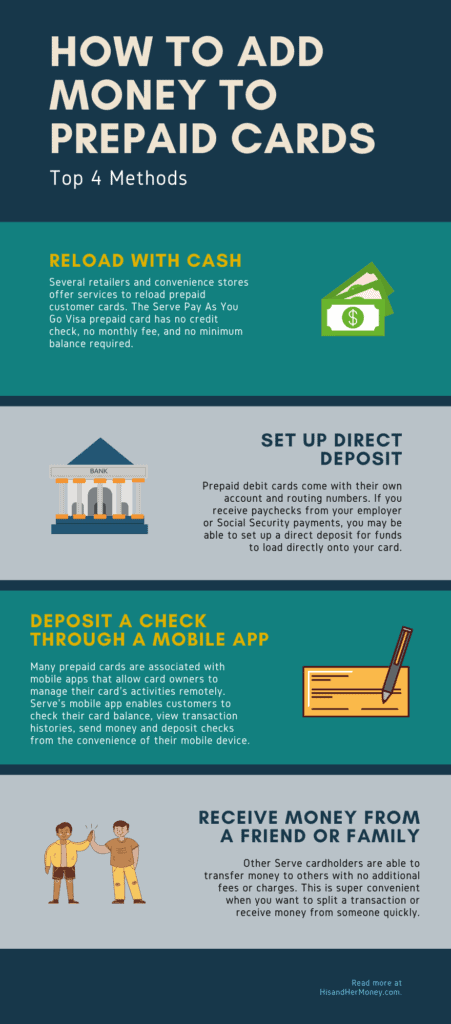

Reload With Cash

Several retailers and convenience stores offer services to reload prepaid cards. Before using a retailer, make sure to ask if they charge any fees in addition to a possible reload fee from the card merchant. The Serve Pay As You Go Visa Prepaid Card charges up to $3.95 for each cash reload at retail locations.

Set Up Direct Deposit

Prepaid debit cards come with their own account and routing numbers. If you receive paychecks from your employer or Social Security payments, you may be able to set up a direct deposit for funds to load directly onto your card. With the Serve Pay As You Go Visa Prepaid Card, you can set up direct deposit for free and could receive your pay up to two days early.

Deposit a Check Through a Mobile App

Many prepaid cards, especially those from a bank, are associated with mobile apps that allow card owners to manage their card’s activities remotely. Serve’s mobile app enables customers to check their card balance, view transaction histories, send money to other Serve users or accounts, and, where applicable, deposit checks from the convenience of their mobile device.

Receive Money From a Friend or Family

Serve cardholders are able to transfer money to other Serve cardholders with no additional fees or charges. This is super convenient when you want to split a transaction or receive money from someone quickly.

What Kind of Fees Do Prepaid Cards Charge?

While prepaid cards can be a convenient way to budget and pay for daily expenses, most convenient things in life tend to cost a bit more money – prepaid cards included.

The national average fee to purchase and fund a prepaid card is between $5 and $10. Serve Pay As You Go Visa Prepaid Card only has a purchase price of $1.50 in-store and $0 if you register online. Many cards also charge between $5 and $15 in monthly fees. However, the Serve Pay As You Go Visa prepaid card has no monthly usage fees – cardholders instead pay a small fee per transaction.

Do Prepaid Cards Help My Credit History?

Since funds that are loaded onto the card are your own and not borrowed from any bank or credit union, there is no credit activity to report to any of the major credit bureaus. Prepaid debit cards won’t help you build up your credit history because they are not linked to credit in any way. Secured credit cards are a good way to show lenders that you can borrow money responsibly and pay it back on time without maxing out your credit line.

Secured cards require large cash deposits upfront to cover the credit line in the event the account goes unpaid. Because of this, you’re not accessing any “extra” money, just proving that you can borrow responsibly. Over time, this will improve your credit history and allow you to apply for conventional unsecured credit cards and accounts.

Prepaid Cards

Prepaid debit cards look and function just like bank account debit cards but aren’t linked to any specific bank account. Both types of cards do not require credit checks and do not report transaction or spending data to the major credit bureaus.

According to a 2019 survey conducted by the FDIC, 7.1 million households in the United States did not have a checking or savings account. Instead of going through the hassle and paperwork of opening a bank account, prepaid cards can be activated on the spot in a matter of seconds.

Since they come with their own account and routing number, prepaid cards can also be used for employer direct deposit and other transactions that would typically require a wire transfer from a checking account.

Prepaid Cards vs. Secured Credit Cards

While prepaid debit cards are used for budgeting and making online purchases, secured credit cards are used to build credit history. The most significant difference between prepaid cards and secured credit cards is who owns the money being spent.

With a secured credit card, money is borrowed from a bank or credit union and paid back with interest. A cash deposit is required from the customer to secure the credit limit in the event payments are not made. The deposit is not used to cover the statement balance or purchases made – that still needs to be paid separately. The lender only uses the security deposit in the event the account becomes delinquent. All payment activity is reported by the lender to the major credit bureaus and will affect credit history.

Prepaid debit cards have money loaded onto them before any purchases are made. The money is not borrowed from any lender and is the customer’s own money. However, because there is no credit check or reportable credit history, a prepaid card does not help build credit history.

In Summary

Even though a prepaid debit card won’t help you build up your credit history, it can be a great tool to help you avoid or get out of debt. Further, they can be a valuable method of budgeting and refining spending habits for those who have difficulty managing credit cards responsibly.

Serve’s Pay As You Go Visa Prepaid Card users also benefit from free early direct deposit, fraud protection, no transaction fees, a mobile app, and the ability to add additional cash directly at thousands of retail locations.